retirement

Coronavirus-related 401(k) Distributions and Your Taxes

Submitted by The Participant Effect on September 30th, 2020Tax-wise Investing: Planning 401(k) Distributions

Submitted by The Participant Effect on September 30th, 2020

An important part of tax planning when it comes to investing is considering the tax impact of accessing your investment funds. As you know, one of the key features of the traditional 401(k) retirement account is that you can contribute pre-tax dollars from your income, which then grow tax free until you need them.

Municipal Bonds, Taxes and Your Retirement

Submitted by The Participant Effect on September 30th, 2020Is a Roth 401(k) Right for You?

Submitted by The Participant Effect on September 30th, 2020

You may know about Roth IRAs, but did you know that many employers now give retirement plan participants a Roth 401(k) option? Both traditional and Roth 401(k)s offer significant tax benefits for investors, but those benefits differ in ways that are important for you to understand.

Traditional Values

Medicare And Long-term Care

Submitted by The Participant Effect on August 4th, 2020

There may come a time when tasks like putting on your pants and brushing your teeth are difficult without assistance. The federal government projects that almost 70 percent of Americans turning 65 now will eventually need long-term care. How much care you think you’ll need, and how you’ll pay for it, is an essential part of prudent retirement planning.

What Is Medicare Advantage?

Submitted by The Participant Effect on August 4th, 2020

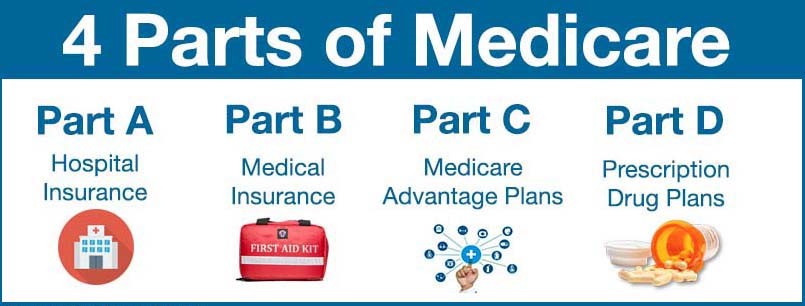

Medicare Advantage plans, often called Medicare Part C, are sold and administered by private companies. Medicare pays these companies a fixed fee for each enrollee, and they’re required to provide at least as much coverage as Original Medicare (Parts A and B.) Some plans even offer customer rebates.

Medicare 101

Submitted by The Participant Effect on July 8th, 2020

Signed into law by President Lyndon Johnson in 1966, Medicare now covers nearly all Americans over age 65. And they’ll need the help: Projections indicate that a healthy couple who retired in 2019 could expect to spend over $385,000 in insurance premiums and out-of-pocket costs to cover their healthcare needs.