Medicare 101

Submitted by The Participant Effect on July 8th, 2020

Signed into law by President Lyndon Johnson in 1966, Medicare now covers nearly all Americans over age 65. And they’ll need the help: Projections indicate that a healthy couple who retired in 2019 could expect to spend over $385,000 in insurance premiums and out-of-pocket costs to cover their healthcare needs. This is not including costs of long-term care like a home health aide for less severe conditions— and that’s after factoring in coverage from Medicare. The impact of healthcare costs on retirees is enormous, and for many, Medicare is their primary lifeline. But if you’re a bit fuzzy on Medicare, you’re not alone. Let’s do a little “unboxing” and find out what Medicare really is and what it means to your financial future.

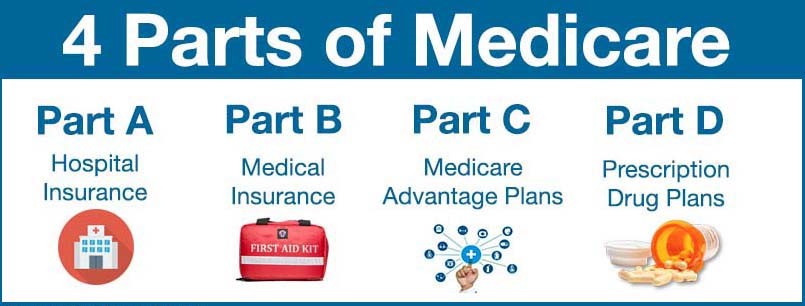

Medicare has four sections: Parts A and B, known collectively as Original Medicare, and Parts C and D, which are the result of later legislation. Right out of the gate, realize that not everyone is covered by every “Part,” and the program is not entirely free: There are premiums for some parts as well as co-pays, deductibles and lifetime caps on some benefits.

Part A

This can cover inpatient hospital stays, care in a skilled nursing facility, hospice and some home health care. Part A is free if you’ve worked in a job in which you pay the Medicare payroll tax for 39 or more quarters (about 10 years). For those who didn’t, you can access these benefits but you’ll have to pay for them, which could run you upwards of about $450 per month (depending on how many quarters you’ve paid Medicare payroll taxes). There are limitations on how many days of in-patient hospital and nursing care you can receive, and there are still co-pays and deductibles.

Part B

Certain doctors’ services, outpatient care, medical supplies and preventive services are covered under Part B. The cost depends on your income. If your income is less than $87,000 per year (or $174,000 for a couple), the standard monthly payment is $144.60 in 2020. If your income is higher, the premium will be higher. In addition, there’s a 20% co-pay for many covered services and a yearly deductible of about $200.

Part C

Also known as “Medicare Advantage,” Part C plans are sold and administered by private companies that bundle together Part A and Part B benefits (and many include Part D benefits). There are many Medicare Advantage plans at widely varying costs — HMOs and PPOs being the most common. However, all of them must cover at least the same services as Original Medicare. Some states mandate additional coverages they must provide.

Part D

This is a prescription drug benefit that can be used with Original Medicare and some private plans, including some Medicare Advantage plans. Part D lowers the cost of prescription drugs — which can be a major part of overall healthcare costs for seniors. You can buy Part D as part of a Medicare Advantage plan or as supplemental insurance (sometimes referred to as Medigap). Monthly premiums for Part D coverage average around $30, and there are co-pays and deductibles that vary according to the plan you choose.

There’s much, much more to Medicare, and you’ll find helpful information on the Medicare.gov website. Healthcare is a critical part of retirement planning: It’s often one the largest expenses you’ll have, and taking the time to understand how Medicare and private insurance can work together to keep you physically — and fiscally — fit can pay dividends for years to come. You can talk to your financial advisor or a Medicare “navigator” who specializes in helping people understand and get the most from the program.

Sources:

https://www.medicare.gov/what-medicare-covers/your-medicare-coverage-cho...

https://www.medicare.gov/your-medicare-costs/part-a-costs

https://www.medicare.gov/your-medicare-costs/part-b-costs

https://www.mymedicarematters.org/costs/part-d/

https://www.medicare.gov/sign-up-change-plans/types-of-medicare-health-p...